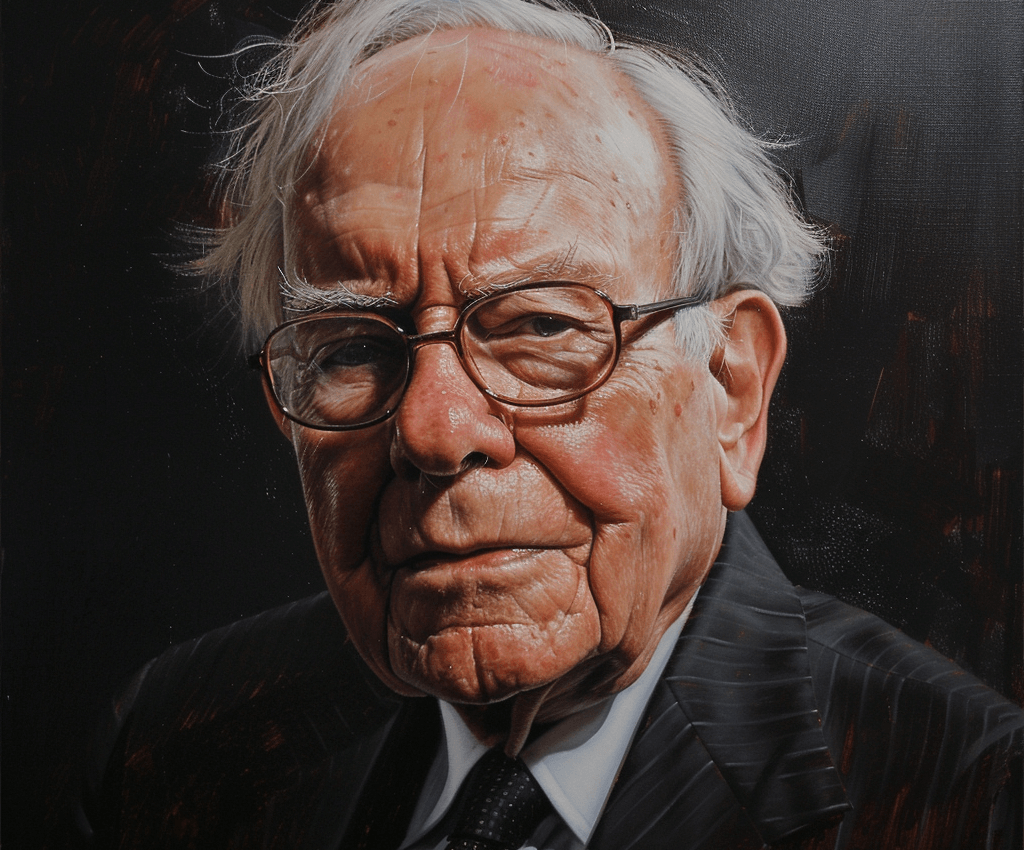

Warren Buffett: The Oracle of Omaha’s Journey to Billionaire Investor

Warren Buffett, often referred to as the “Oracle of Omaha,” is a paragon of investment prowess and one of the most successful investors of all time. His journey from a young boy fascinated by the world of business to the chairman and CEO of Berkshire Hathaway is a testament to his unparalleled investment acumen, discipline, and a profound understanding of the value investing philosophy. This article delves into the success story of Warren Buffett, exploring how he built his empire and the principles that guided him along the way.

Early Beginnings

Warren Buffett’s journey into the world of finance began at an early age. Born in Omaha, Nebraska, in 1930, Buffett displayed an early interest in making and saving money. He embarked on his first business venture selling chewing gum, Coca-Cola bottles, and weekly magazines door to door. By the age of 11, he made his first stock purchase, buying three shares of Cities Service Preferred for himself and his sister, Doris. This early foray into the stock market sparked a lifelong passion for investing.

Education and Early Career

Buffett’s keen interest in the stock market led him to the University of Pennsylvania’s Wharton School before transferring to the University of Nebraska, where he graduated with a Bachelor of Science in business administration. He furthered his education at Columbia Business School, where he was mentored by Benjamin Graham, the father of value investing. Graham’s teachings profoundly influenced Buffett’s investment strategy, emphasizing investing in undervalued companies with strong potential for long-term growth.

After working for Graham at his partnership, Buffett returned to Omaha and started his own investment partnership in 1956. With an initial investment of $100,000, largely from family and friends, Buffett’s astute investments quickly grew the partnership’s assets.

The Berkshire Hathaway Era

In 1965, Buffett’s interest in a textile company named Berkshire Hathaway would mark the beginning of an era that would eventually transform it into a conglomerate holding company with a massive portfolio of businesses and investments. Buffett gradually shifted Berkshire’s focus from textiles to insurance and other investments, applying his value investing principles to acquire companies at prices below their intrinsic value.

Under Buffett’s leadership, Berkshire Hathaway has grown into one of the largest and most successful companies in the world, with a diverse portfolio that includes insurance, energy, transportation, and consumer goods, among others. The company’s annual shareholder meetings, dubbed the “Woodstock for Capitalists,” attract thousands of investors from around the globe, eager to hear Buffett’s insights on investing and the economy.

Investment Philosophy and Principles

Buffett’s success can be attributed to his disciplined adherence to the value investing philosophy, focusing on companies with strong fundamentals, competent management, and the potential for long-term growth. He advocates for a long-term investment horizon, famously stating, “Our favorite holding period is forever.” Buffett’s approach emphasizes patience, discipline, and a thorough understanding of the businesses in which he invests.

Beyond his investment acumen, Buffett is renowned for his frugality, philanthropy, and practical wisdom. He has pledged to give away the majority of his fortune to philanthropic causes, primarily through the Bill & Melinda Gates Foundation, embodying his belief in giving back to society.

Legacy and Impact

Warren Buffett’s legacy extends beyond his extraordinary investment success. He has inspired countless individuals to pursue value investing, emphasizing the importance of reading, lifelong learning, and ethical business practices. His annual letters to Berkshire Hathaway shareholders are studied by investors worldwide for their insights into his investment philosophy and views on the economy.

Conclusion

Warren Buffett’s journey from a paperboy in Omaha to one of the wealthiest individuals on the planet is a remarkable story of success, discipline, and unwavering commitment to a set of investment principles. The “Oracle of Omaha” continues to be a guiding light for investors, demonstrating that integrity, patience, and a keen understanding of business can lead to unparalleled success in the world of investing.